The Business of Design Is Being Redefined: Six Disruptions AEC Firms Can’t Ignore—And What to Do About Them

Since launching Oomph in 2020, we’ve been tracking the digital transformation slowly reshaping architecture, engineering, and construction. But today, digital disruption is just one wave in a much larger storm.

The AEC industry is being hit by a powerful convergence of change—economic shifts, immigration policy updates, generational turnover, new technologies like AI, and the rise of industrialized construction methods. These forces are colliding all at once, disrupting long-standing business models and forcing firms to rethink how they operate, who they serve, and how they deliver value.

Nowhere is this more visible than in Toronto and Vancouver, where condo markets have collapsed, office towers sit vacant, and building pipelines are thinning out. The effects are cascading across the country.

Across six interconnected fronts, the business of design is being fundamentally redefined.

Here’s what’s unfolding—and how future-focused firms can respond. 👇

1. Condo Market Collapse

Toronto’s condo market has experienced a dramatic downturn, with sales plummeting 75% since 2022. Vancouver has also seen a significant decline, with sales down 37% over the same period. In March 2025 alone, housing starts dropped 65% in Toronto and 59% in Vancouver compared to the previous year. Meanwhile, the pre-construction market is struggling, with 55% of new condo units in Toronto remaining unsold as of Q1 2025.

✅ Strategic response: diversify beyond private condos

✅Tactics:

Pursue public-sector residential work [e.g., affordable, supportive, student, and seniors’ housing] via municipalities, housing authorities, and universities.

Reposition unsold or stalled condo projects: Offer retrofit/repurposing design solutions to convert them into rentals, co-living, or mixed-use.

Collaborate with developers to optimize cost: Use value engineering and modular approaches to revive marginal condo projects in construction limbo.

Strengthen design-assist and pre-construction services: Help developers rework pro formas by reshaping building form, systems, and finishes to align with rental metrics.

2. Immigration Policy: Impact on Education

Canada’s international education sector is feeling the effects of new immigration policies, with student permit caps reduced by 10% in 2025 to 437,000, down from a peak of approximately 650,000 in 2023. In Q1 2025, the number of study permit holders declined by 11% year-over-year, with Indian student permits seeing an even steeper drop—down 31% compared to Q1 2024.

✅ Strategic Response: Target alternative residential growth markets

✅ Tactics:

Shift toward domestic demand-driven sectors like non-profit co-op housing, supportive housing, and rental conversions.

Develop campus housing expertise: Work with institutions needing to accommodate more students on-campus due to permit caps.

Support mid-size cities and municipalities: Position as a partner to rapidly growing second-tier cities facing housing shortages and infrastructure gaps.

Align with housing policy goals: Demonstrate how your design approach meets CMHC priorities—sustainability, affordability, and rapid delivery.

3. Office Market Disruption

Canada’s office market continues to face mounting challenges. As of Q1 2025, national office availability reached 17.1%, with vacancies rising and older Class B and C buildings under increasing pressure. Active office construction has slowed to a 20-year low, with only 3.2 million square feet in the national pipeline—less than 1% of existing inventory. In Toronto, downtown Class A and B vacancies are hovering around 14.5%, as the market struggles to absorb new supply amid softening demand.

✅ Strategic Response: Reimagine aging office assets and capitalize on the retrofit wave

✅ Tactics:

Specialize in adaptive reuse and conversion: Offer feasibility studies and full design for converting Class B/C office stock into residential, hotel, lab, or educational space.

Create ESG-focused repositioning packages: Help landlords and REITs upgrade energy performance and accessibility in aging buildings.

Design for hybrid work realities: Offer interior retrofits and workplace consulting that reflect new tenant expectations.

Market niche workplace projects: Pursue government, healthcare, and education clients still investing in future-ready workspaces.

4. Leadership + Demographic Transitions

A wave of retirements among Boomers and older Gen X firm owners is reshaping the AEC industry. As leaders step down, succession planning, mergers, and generational shifts in values and priorities are redefining how firms operate and the markets they serve.

✅ Strategic Response: Leverage generational turnover to reshape firm identity and services

✅ Tactics:

Position succession as transformation, not just continuity: Use leadership changes to refresh brand positioning, diversify services, and sharpen your market focus.

Recruit emerging leaders with entrepreneurial mindsets: Look for next-gen talent with interests in business development, tech adoption, and sector specialization.

Pursue strategic mergers or alliances: Join forces with like-minded firms to expand geographic reach, talent bench strength, or specialized expertise.

Market cultural evolution: Communicate how new leadership reflects changing client values—equity, climate action, and digital fluency.

5. Digital Revolution

AI is proving to be as transformative for the design industry as CAD was in its time, fundamentally reshaping expectations, workflows, and client deliverables. While forward-thinking firms are actively investing in new tools and capabilities, others are struggling to keep pace with the rapid evolution.

✅ Strategic Response: Become a tech-forward firm by design, not default

✅ Tactics:

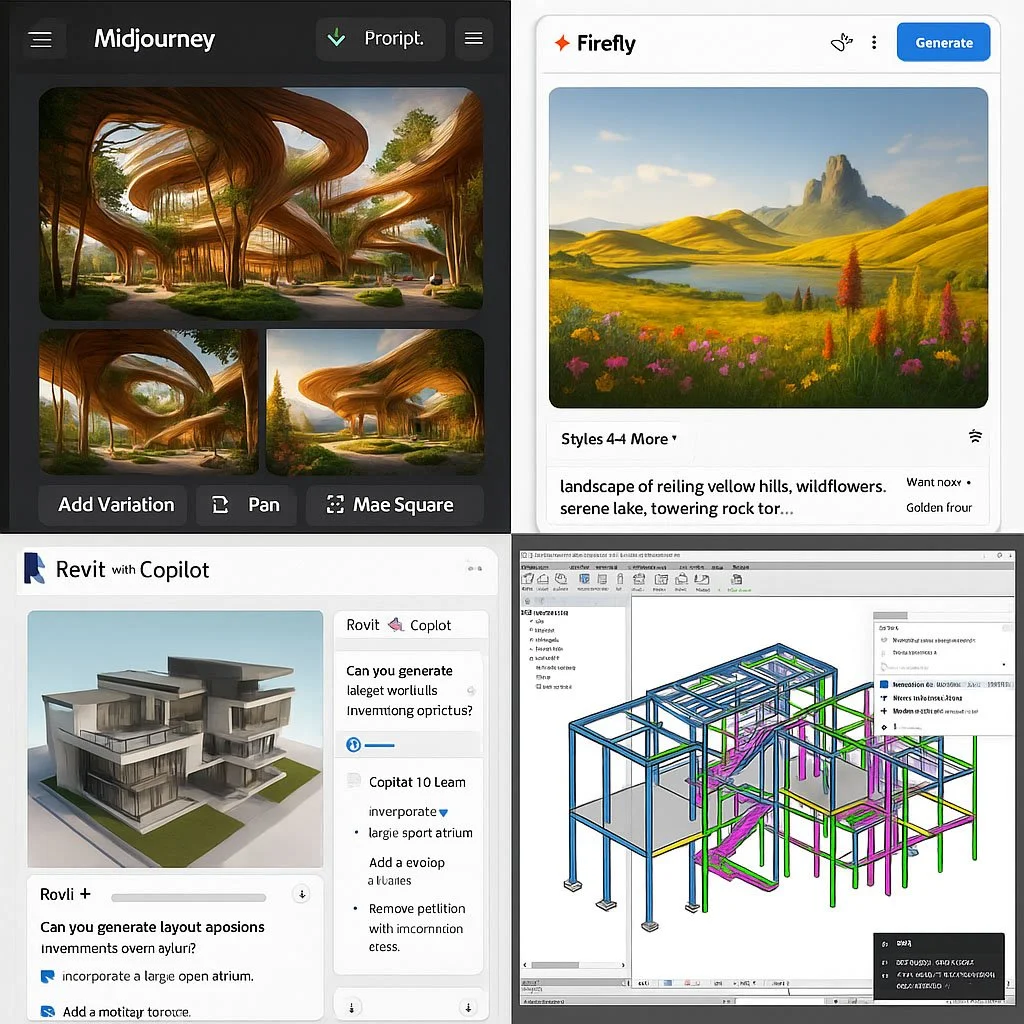

Develop internal AI guidelines and upskilling pathways: Empower staff to safely and strategically use tools like Midjourney, Firefly, TestFit, and Revit Copilot.

Invest in design technology R&D: Pilot AI-assisted feasibility studies, massing generation, and energy modeling to accelerate early-phase work.

Differentiate through data-rich deliverables: Position BIM, digital twins, and automated documentation as high-value client offerings.

Lead with thought leadership: Publish case studies or demos showing how tech enhances design thinking—not just efficiency.

6. Industrialized Construction

Prefab and modular construction methods are rapidly gaining traction, increasingly viewed as the future of efficient building delivery. These approaches—factory-manufactured and assembled on-site—offer the potential to reduce timelines, improve quality control, and lower costs across a range of project types.

✅ Strategic Response: Align design expertise with off-site construction innovation

✅ Tactics:

Partner with prefab and modular suppliers early: Co-develop system-based designs that integrate with supply chain and factory methods.

Specialize in sectors primed for prefab: Focus on housing, student residences, healthcare, or remote community infrastructure.

Train design teams in DfMA (Design for Manufacturing and Assembly): Shift from bespoke detailing to systems thinking and interface coordination.

Use speed as a value proposition: Market your ability to help clients cut delivery time, improve quality control, and reduce site risk.

Sources

Condo Market Collapse

Immigration Policy: Impact on Education

Office Market Disruption